Rogue traders are always with us. Embedded in the bowels of most big proprietary trading institutions is a deep-seated streak of irrationality that, when awakened, will tempt fate. Or, at least, that is the view of most behavioural economists.

Debt collectors

Some of the highest debts owed by rogue traders:

$691m, John Rusnak, Allfirst Bank

£827m, Nick Leeson, Barings Bank

€1.49bn, Kweku Adoboli, UBS

€4.9bn, Jerome Kerviel, Société Générale

$9bn, Howard ‘Howie’ Hubler, Morgan Stanley

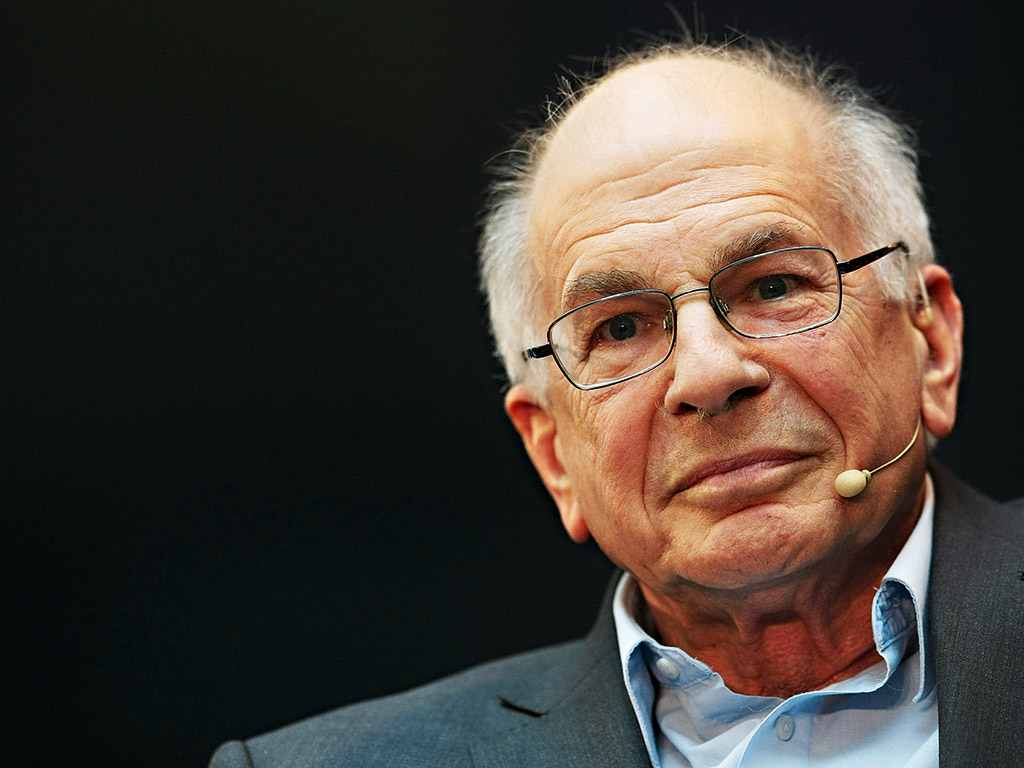

Daniel Kahneman, the Nobel prize-winning Israeli-American psychologist and one of the fathers of behavioural finance, knows why traders turn the fatal corner. As they get into trouble – or, at least, fail to meet their own expectations in terms of wealth or reputation, they lose their sense of rationality. Instead of thinking their way back from the brink of disaster, which should usually start by confessing their errors or adopting an alternative strategy, they start to gamble in the conviction that they can somehow achieve a miraculous restoration of the status quo.

In short, their egos cannot cope with what they define as failure – an admission they were wrong or, worse, a confession of wrongdoing. And so they switch from the techniques of risk aversion, which they have been taught is the true art of the trader, to the much more dangerous one of loss aversion. At that point the game is probably up.

Kahneman describes this as the “reference point”, the trigger event that leads to the abandonment of rationality. “Utility [the value people place on something] cannot be divorced from emotion, and emotion is triggered by changes,” points out Kahneman in his best-selling book Thinking, Fast and Slow. “A theory of choice that completely ignores feelings such as the pain of losses and the regret of mistakes is… unrealistic.”

As deep-thinking columnist John Plender of the FT, citing Kahneman, writes: “He was describing the psychological make-up of the average human being, but the desperate scramble to avoid losses at all costs is a defining characteristic of the rogue trader.”

Nick Leeson, the man who brought down Barings Bank in 1995, sums it up in Rogue Trader. “I was well down, but increasingly sure that my doubling up and doubling up would pay off… this is gambling at its simplest. If you double up, you halve the amount the market needs to turn for you to make your money back, but you double the risk.”

Rusnak roulette

At the 2000 Superbowl between the St Louis Rams and the Tennessee Titans, star Wall Street trader John Rusnak was having a great time. He had been invited as a special guest to the Georgia Dome with a group of other traders from a rival bank. With more than a few beers in his belly, 35-year-old Rusnak wasn’t content merely to watch the football – he was gambling on the outcome. In a complicated play based on the number of points scored by players with the highest and lowest jersey numbers in the constant battle between offence and defence, he was duelling with his fellow guests. Thousands of dollars were on the table. As the points mounted, the odds shifted wildly in favour or against Rusnak’s position. Thinking on his feet, the star trader kept taking positions on the fly and then covering them, one man against the market.

This was what he loved to do and he was good at it, one of the best. He was, in his own words, “prideful and arrogant”. But he was also sowing the seeds of his own destruction. Rusnak had become so imbued in the “perverse culture” of Wall Street, as he now puts it, that he had to turn even a Superbowl game into a battle between derivatives dealers. The mentality of Manhattan, the epicentre of global trading, had changed a church-going, God-fearing but, crucially, confidence-lacking boy from Bucks County, Pennsylvania, into a man who had lost his way.

In less than three years, Rusnak would be in prison, starting a seven-and-a-half-year sentence for hiding from superiors and regulators $691m in derivatives-based currency losses at Baltimore’s Allfirst Bank, a subsidiary of Ireland’s AIB. It was one of the biggest-ever bank frauds and it resulted, explains a contrite Rusnak, from a blind determination to prove himself in one of the most competitive of businesses, no matter what it took. Although he continued to attend church, during the working week he was “always trying to make as much money as possible”, he now says. “I had a choice between good and evil but I led this crazy, manic dichotomy in my life.”

Even when the Allfirst trade – a bet against greenback/yen values – turned sour in 2001, he tried to brazen it out, inducing others to lie on his behalf while he did his best to rescue the situation by throwing more and more of his bank’s money into the pot. “I thought I was smart enough to get it back”, he remembers. “It was such a bad decision, laden with sin.” For two years he worked 24/7, drinking heavily.

But revealingly, when his deception was eventually rumbled, Rusnak was happy rather than dismayed. “I knew very clearly the jig was up,” he recalls. “It was a huge relief, a weight off my shoulders.” The news also turned out to be a spiritual turning-point for the rogue trader. In five-and-a-half-years in prison before he was eventually released into home confinement, Rusnak says he regained his soul.

Banned for life from employment in the financial sector, he is back at work as president of Pilgrimage Development that runs the Zips Dry Cleaners chain of stores. He also spends time with a Baltimore-based organisation called unCUFFED, which helps young former prison inmates get a second chance. At the same time he is paying back the $691m he lost, at the modest rate of $1,000 a month.

About his former life, Rusnak, now 49, makes one further admission: “For sure, trading is like gambling.”

Black belt spills red ink

When Jerome Kerviel joined the trading desk of France’s third-biggest bank, Société Générale, in 2005, he felt like an outsider. “I was held in lower regard than the others because of my educational and professional background,” he would later tell prosecutors. Kerviel, who hailed from Brittany, had attended a minor university. But at Société Générale he was sitting alongside traders who had been hired from some of France’s most elite schools, the ones that had produced the country’s presidents and prime ministers.

A black belt in judo, Kerviel set himself a mission – he would show his superiors he was better than his colleagues. Diligent and intelligent, the new boy rose steadily through the ranks. As he made more and more money for Société Générale in his speciality market of German stock prices, he was given increasingly high limits. In one year alone he produced €1.5bn in profits for the bank. Eventually his superiors, all of whom were booking bonuses as a result, raised Kerviel’s limits by 1,700 percent and, the trader would insist at his trial, they deactivated the system of alerts on his desk so their superiors would not know what was happening. Eventually, he had open positions with a breathtaking notional value of €30bn.

Kerviel was dazzled by how easy it was to conjure up vast sums of money as a trader, as if by magic. “To invest €150m, it only takes a second. For €1bn, you need four seconds,” he told investigators – a startling insight into the temptations exercised on ambitious young people by the merry-go-round of the derivatives market. “Things go so quickly with computers that you lose any sense of the amounts involved. The international market is so big that it absorbs all orders in just a matter of seconds. The wheel continues to spin faster and faster. It’s insane.”

The unauthorised trades were discovered in January 2008 when the market turned against Kerviel. By then it was too late. In 2010 Kerviel, the scapegoat, was sentenced to five years in prison with two years suspended and was handed the biggest IOU of all time – the 37-year-old was told that he would have to pay €4.9bn. After several failed appeals, Kerviel lost one further appeal against his jail sentence in March 2014, but the €4.9bn fine will be reviewed at a later date and it is possible that he will no longer have to pay so much.

Quaker trader

What turns a head boy of a Quaker school and model employee of UBS into a rogue trader? In the case of then 31-year-old, Ghanaian-born Kweku Adoboli, the man who lost the bank €1.49bn in 2011, the answer is a head-turning cocktail of a healthy sense of ambition perverted by a bonus-led culture that handsomely rewards winning bets, lax management and easily fooled internal systems.

In 2006 Adoboli was put on the Delta One desk that deals in exchange-traded funds, a method of buying and selling equities through the easier route of indexes rather than through individual shares. Adoboli’s particular corner of this vast universe was EuroStoxx, DAX and S&P500 indexes. At UBS there was a rulebook for dealing exchange-traded funds and Adoboli’s seniors were supposed to ensure he complied with it. And he did, at least outwardly. But Adoboli had found a simple weakness in the system. Every time he made a trade, he ‘forward settled’ his cash position – that is, registering payments before they had in fact come in. In short, Adoboli was clocking a profit before he’d made it – in fact, even when he knew he had made a loss – and then carrying that ‘profit’ into the next trade. Thus he was setting off his exposure by working the system.

This wasn’t as nefarious as it may at first seem. There is a convention in the financial markets known as ‘fails to deliver’. It means trades are booked before the securities concerned have been delivered and before money changes hands. The convention is based on an underlying integrity – the security will indeed turn up. According to market analysts, the notional value of failures to deliver can run as high as $200bn a day. In this great dishwasher of funds, even relatively junior traders such as Adoboli have a dangerous amount of financial muscle if they know how to fiddle the system.

Thus Adoboli was able to run up €1.49bn in losses in just three short months. Sentenced in 2013 to seven years imprisonment for fraud, Adoboli said he “was sorry beyond words for what has happened”, but insisted that he had only been trying to make profits for the bank in line with UBS’s culture.

Chest-thumping trades

The man behind the biggest-ever trading loss to date is Howard ‘Howie’ Hubler. A Wall Street kingpin in the sub-prime market, he cost Morgan Stanley around $9bn in 2008 after going out on a limb on house prices in the US. A leading figure in Michael Lewis’ best-seller The Big Short about the sub-prime crisis, Hubler was featured as the high priest of hubris. He is described as “loud, headstrong and bullying”, the archetypal, chest-thumping bond trader taking on the markets. If anybody so much as dared question his trading style, the confrontational trader would tell them to get the hell out of his face.

The chubby-faced Hubler did no wrong that could be prosecuted. He was not a rogue trader. But he personified a Wall Street culture of gambling hugely on events that were merely prospective. In late 2004, he had become one of Morgan Stanley’s biggest earners because, unlike most others, he was taking positions against the subprime mortgage market, which he saw as inherently risky.

By April 2006, Hubler had his own hedge fund within Morgan Stanley and was convinced of his omniscience. With the grand title of the Global Proprietary Credit Group, the fund’s team had taken vast wagers on the imminent doom of the subprime market. Unfortunately for the king trader, Armageddon took too long to arrive. The fund was carrying killing running costs on its subprime bets, so Hubler covered his position by buying up those subprime mortgage pools that he considered less likely to fail. In short, to protect the fund’s liquidity, he had been forced to invest right back into a market whose demise he hoped would happen tomorrow.

By now, the master bond-trader had gone in too deep and could not get out. When the subprime market crashed in late 2008, he was left high and dry. In a culture that encouraged risk-taking, his ‘punishment’ was upwards of $10m in back pay. Today Hubler is chief executive of Loan Value, a company that aims to keep struggling home-owners in their houses by rewarding them with cash if they can maintain their payments. “This time, we have a view that we can help,” explains the man who nearly brought down Morgan Stanley.