Prepaid Financial Services (PFS) has helped shape financial technology in Europe. In 2019, the pace of growth at the company meant it needed to expand rapidly and hire more than 100 new members of staff. The people behind the renowned firm are Noel Moran, two-time winner of European CEO’s Entrepreneur of the Year award, and Valerie Moran, Head of Operations and Client Relations at the company.

PFS has experienced this growth in tandem with the global increase in the adoption of prepaid payment options and fintech-enabled solutions, including wearable technology. Today, governments, banks, mobile phone companies and fellow fintechs rely heavily on the service PFS provides.

PFS is delivering robust payment technology solutions and world-class innovation in electronic money across Europe

Shrewd moves

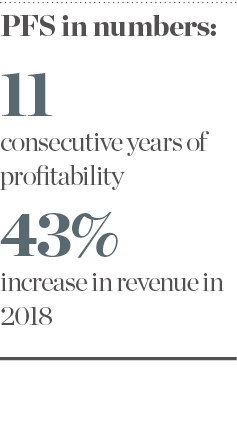

In 2018, the company won the Digital Technology Award in the European Business Awards, and in the same year experienced a 43 percent increase in revenue. Remarkably, it has recorded its 11th consecutive year of profitability – a rare feat for a unicorn. Fintechs tend to follow the venture capital route to acquire funding, but PFS has taken on no external investment. The business won over numerous high-profile customers thanks to its flexible and agile approach, as well as the low-cost model that its in-house technology development system allows it to deliver.

“This year, PFS acquired the Barclays prepaid portfolio,” said Noel. “Regulated by the [Financial Conduct Authority] in the UK, PFS is now one of the few companies to have successfully obtained a licence from the Central Bank of Ireland, which makes us fully prepared post-Brexit. PFS aims to float on the London Stock Exchange’s AIM Index in the first half of 2020. Understandably, the uncertainty created by Brexit got in the way of plans to float in 2019.”

Valerie was recently invited to deliver a keynote address at a private bank in London, where she spoke about the company’s uncanny ability to achieve a consistent level of sustainable profit. Due to PFS’ impressive growth, whenever Noel and Valerie speak at events, crowds gather. Noel recognises the irony of the situation: he was an early school leaver and is now a speaker at universities.

Promoting diversity

PFS has worked hard to become a diverse workplace, promoting gender balance, LGBTQ inclusion and neurodiversity. Its work in these areas earned it a place on the Financial Times’ 2018 Future 100 UK list, which names the companies making a positive social or environmental impact. Close to 44 percent of the company’s staff are from ethnic minorities, while 67 percent of PFS’ workforce in its Wilmslow office in the UK are women. A further 59 percent of its Regent Street headquarters, 57 percent of its Ireland office and 66 percent of one of its development teams are women.

It’s important to note that Valerie has made history as the only black woman to appear on The Sunday Times Rich List 2019. On hearing of her inclusion in the list, she said: “To be the first and only black woman is a complete shock and hard to comprehend. Upon reflection, on many occasions, sometimes I was the only woman in tech in the room over the years. Sometimes, the only black person in the room, male or female. The diversity gap is so enormous. It is certainly not a lack of ideas from people of colour – it’s a lack of support. I hope to engage and encourage more aspiring entrepreneurs of colour, starting from encouraging more girls in school to consider future careers in technology. Education is key to bridging the gap.”

As a major fintech employer, PFS aims to hire the very best talent. It offers its workforce long-term job security and a sense of achievement. The message is clear – everyone is valued by PFS. The company supports a host of community, arts and sporting initiatives, and is the main sponsor of the Future Basketball League Malta. It also encourages young, local entrepreneurs to test their offerings and conduct market research on its staff.

Industry firsts

Like all industry change-makers, PFS’ experienced leadership team members have dedicated their careers to shaping the fintech ecosystem. PFS launched the first prepaid contactless card in the UK and was the first company in the country to offer prepaid current account switching. Today, PFS is one of Europe’s largest electronic money entities and has issued more than six million prepaid cards. It has programmes active in 25 countries – a number that continues to grow – and the ability to carry out transactions in 23 currencies.

PFS is a fast-paced, dynamic organisation. In a regulated space, it aims to continue developing its capacity to deliver world-class client solutions. The company is always looking at ways to improve performance and processes using a structured and systematic approach. PFS’ ability to move quickly sets it apart from other fintech companies, making it the first choice for businesses that need to stay ahead of the curve.

It is an exciting time for the fintech sector. While many traditional businesses are still trying to put together plans for the technology-driven future, fintechs are already delivering completed projects to clients. PFS is at the forefront of this evolution. At present, this involves expansion into new markets in Africa and Asia, and, in time, an initial public offering to open up new opportunities for innovation within the business.

PFS is proudly directing fintech towards a card-free future in a bid to reduce plastic production. The company is already at the forefront of the sector’s ecological evolution: in 2016, PFS was selected to provide the first prepaid Mastercard product line to Belgian cooperative society NewB. Instead of plastic, the cards are made entirely from non-GMO corn.

An environmentally aware and people-focused enterprise, PFS is delivering robust payment technology solutions and world-class innovation in electronic money across Europe. Partnerships with some of the biggest companies in the world, from Google to Samsung, mean it is making positive advances at the heart of the payments market.