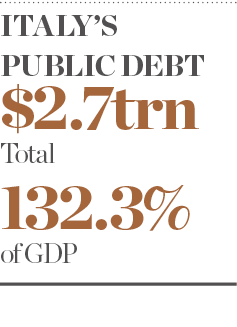

Italy’s economy is in dire straits. The country has the second-highest debt-to-GDP ratio in Europe (behind only Greece) and economic output is yet to return to pre-crisis levels. What is less certain is how best to get out of this sorry situation. Recently, the Italian people decided that the status quo simply was not working any more.

During the 2018 general election, establishment politics was rejected in favour of two populist parties: the Five Star Movement and the League. The result was not entirely shocking – political discontent had been fomenting in Italy for some time – but the surprises have kept coming.

After clashing with the European Commission over its expansionary budget, the Italian Government caused further ire in Brussels by announcing a radical proposal to launch a new type of tradable security: ‘mini-BOTs’. Supporters of the idea believe it will enable the country to return to growth, but critics claim it is the first step towards Italy crashing out of the eurozone.

Cash clash

“I don’t govern a country on its knees,” proclaimed Deputy Prime Minister Matteo Salvini back in June after his party swept to victory in the latest European elections. His defiant tone reflected the fact that Italy’s government and the EU have been in conflict for some time.

Last year, the European Commission initially rejected the Italian Government’s proposed budget after accusing it of breaching EU rules, raising fears that the bloc could issue hefty fines. Although that crisis appears to have passed, another has emerged: with the EU pressuring Italy to rein in expenditure, Rome is exploring whether a potential loophole could allow it to boost growth another way.

Mini-BOTs – named after buoni ordinari del tesoro, a short-term Italian Treasury bill – would be non-interest-bearing securities that could be used by citizens to pay taxes and purchase services and goods from the state. They would inject some much-needed liquidity into the economy and could potentially enable the government to finance deficit spending without contravening eurozone rules.

With the EU pressuring Italy to rein in expenditure, Rome is exploring whether a potential loophole could allow it to boost growth another way

“The Italian Government would issue mini-BOTs – small-value notes – to meet overdue payments to government suppliers,” explained Florian Hense, a European economist at Berenberg Bank. “The mini-BOTs could also be issued as credits to taxpayers entitled to refunds. They would not pay interest and have no due date. They would be guaranteed by the state and would be accepted by the government for the payment of taxes. As such, they would have money-like characteristics. Proponents of mini-BOTs, however, stress that [they] are not money, as there would be no obligation for third parties to accept them.”

Italian politicians can stress that mini-BOTs are not money as much as they want, but in practice, if they are being exchanged for products and services, the distinction matters little. Whether it is the intention or not, mini-BOTs could very quickly become the new lira.

Eur gone

While other countries have made a recovery – albeit a muted one – following the 2008 financial crisis, in Italy, the hangover has proven more difficult to shake off. More than one in four citizens remains at risk of poverty or social exclusion. Progress has been made concerning unemployment, but often job-creation initiatives have only provided part-time roles, meaning job security remains low. In fact, GDP per capita, when adjusted for inflation, is even lower than it was in 2000. The Italian Government plans to spend its way out of this slump, at first through an expansionary budget or, if that’s not viable, via mini-BOTs.

Currently, investors don’t know whether Italians will need to make space in their wallets for the new security or not. Politically, the idea has some support, particularly among Salvini and his closest economic advisors. But others, fearful of spooking the markets, have distanced themselves from the plan. “Proponents of mini-BOTs suggest their issuance could accelerate payments to creditors and suppliers, a motion Italy’s lower house has unanimously approved,” Hense said. “The treasury, however, has denied any plans to issue mini-BOTs.”

Evidence suggests that the proposal’s naysayers are more likely to be right than its supporters. Experiments with alternative currencies have been trialled in a multitude of markets throughout history, with varying degrees of success. Problems largely arise because of Gresham’s law, which states that ‘bad money drives out good’. When two currencies are in circulation concurrently, citizens are more likely to save the ‘good’ money, trusting its long-term value more, while spending the ‘bad’ – creating a situation where the good money drifts out of use.

In Italy’s case, mini-BOTs are unlikely to command the same level of trust as the euro, and even if they did, would not be accepted internationally. If such a situation were to play out, wealthier members of society would be unlikely to accept mini-BOTs, creating a two-tiered economy that would leave Italy’s poorest even more marginalised.

The other issue is that mini-BOTs will only serve to exacerbate the country’s debt burden. If, as Italian politicians claim, the new security is not currency, then there is only one possible alternative: debt. Italy is already weighed down by $2.7trn (€2.41trn) of public debt, and mini-BOTs would see this figure increase unless the definition of public debt is altered – something that Italian politicians have asked for. They are unlikely to get their wish.

My word is my bond

“Mini-BOTs could be a way around limits on government debt set by the EU,” Hense told European CEO. “After all, the [Five Star]/League coalition set off in June 2018 with an agenda that included several expensive election promises. They could also be the first step for Italy to leave the eurozone by introducing a parallel currency to the euro.” The latter is the more worrying scenario.

Although Italy could not openly announce its intention to leave the euro without significant financial damage occurring, including investors pulling money out of the country, the government could prepare for ‘Ital-exit’ in secret, with mini-BOTs laying the groundwork. The credit rating firm Moody’s has already declared that it would view the launch of mini-BOTs as preparation for a departure from the euro area. During the height of Greece’s economic troubles, former Finance Minister Yanis Varoufakis secretly planned to establish an alternative currency before ditching the euro.

Of course, Italy’s departure would have wider ramifications; other member states might decide to issue their own money the next time they find themselves in disagreement with Brussels. The eurozone would be fractured – perhaps beyond repair.

This, of course, is a worst-case scenario. It may be that the Italian Government does not actually intend on issuing mini-BOTs at all, but simply wants to put pressure on the European Commission. Certainly, there are alternative options that Italy could take to fix its economic troubles: instead of focusing on debt, the Italian Government would be better served by prioritising growth and implementing a number of systemic reforms to get the country back on track.

Italian businesses must be encouraged to scale and innovate. A staggering 95 percent of firms have fewer than 10 employees, meaning they suffer from inefficiencies that simply aren’t present in larger organisations. Additionally, less than one in 10 non-financial businesses in the country currently sells online. Digitalisation would allow companies to target customers beyond their immediate vicinity – potentially even those based abroad. Attracting more foreign investment must also be a priority.

These are some of the issues that should be taking centre stage in the Italian Parliament, not the prospect of launching an alternative currency. But often it is easier for populist politicians to blame the EU for issues that, in reality, have domestic roots.