For too long, infrastructure in Latin America’s sixth-largest economy has lagged behind that of its neighbours. Adverse weather conditions, such as last year’s floods, have exacerbated the situation and emphasised just how problematic Peru’s infrastructure gap is.

Fortunately, such issues have also brought this gap to the forefront of political discussion. Consequently, in 2018, a monumental shift began taking place: between this year and next, numerous infrastructure projects to the tune of $11bn (€9.5bn) will be instigated.

Those set to make the biggest contribution to Peru’s economic development work in the hydrocarbon, transport, water and sanitation sectors. Among them is a new natural-gas grid system, stretching across the Apurímac, Ayacucho, Huancavelica, Junín, Cusco, Puno and Ucayali regions. Set to cost $350m (€301.5m), the project is due to be awarded in the last quarter of 2018.

During the first quarter of 2019, another two significant projects will be awarded: the Huancayo-Huancavelica railway, an exciting new development with an estimated investment value of $235m (€202.4m); and the Headworks and Conduction for the Drinking Water Supply in Lima, a $600m (€516.9m) water and sanitation project in the Peruvian capital.

Stable climate

Thanks to a prolonged period of stability and a legal framework that is one of the most open and friendly in the region, Peru has achieved steady economic growth in recent years. In line with this progress, several large infrastructure projects have been launched in a variety of sectors, demonstrating the confidence that private investors have in the nation.

This sentiment is also reflected in Peru’s investment rating among the world’s three most reputable agencies: Moody’s (A3), Standard & Poor’s (BBB+) and Fitch (BBB+).

Peru presents a huge opportunity for investors, boasting a combination of advantages very few countries possess

Peru’s legal framework is particularly favourable. This is because it doesn’t discriminate against foreign investors, giving them the same treatment afforded to locals, including unrestricted access to most economic sectors, the free transfer of capital, free competition and free access to internal and external credit.

Foreign investors also receive guarantees on private property, while they have the freedom to purchase stocks from locals as well. Finally, foreign parties have access to an international disputes settlement mechanism and are given further reassurances by Peru’s potential OECD membership, which ensures the country implements the organisation’s Guidelines for Multinational Enterprises.

The PPP way

Given its reputation for effective public resource management and accurate time frames, public-private partnership (PPP) is the method of choice for ProInversión, Peru’s private investment promotion agency. The best thing about PPP is its ability to capture the greatest advantages of the private sector for the good of public services. For example, public projects can harness the latest technology and innovations in the market, as well as improve operational efficiency, which is otherwise difficult to achieve.

The private sector also has much greater success in delivering projects on time and within budget – another big bonus for the public sphere. In fact, studies have found that PPP can reduce the life-cycle cost by up to 20 percent when compared with the traditional approach.

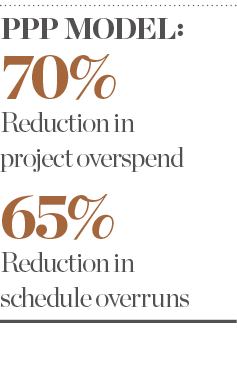

Moreover, according to a study by the UK’s National Audit Office, deploying a PPP model can reduce project overspend by up to 70 percent and schedule overruns by 65 percent. As such, PPPs are a great way of developing local, private sector capabilities through joint ventures with large international firms. What’s more, the risks associated with such projects are transferred to the private sector.

Canada, Australia and the US have been using the PPP model for a number of years now – with great success. Indeed, the Canadian PPP model is considered one of the most effective in the world. For Canada, it takes an average of 16 months to complete a project – from the release of tender to financial closure – compared with an average of 34 months in the UK.

Prioritising sustainable investments

ProInversión receives its mandates from government ministries and grantor entities in a variety of sectors. Once a mandate is received, our board of directors – comprising the Ministry of Finance, the Ministry of Energy, Mining and Hydrocarbons, and the Ministry of Transport and Communications – grants approval, prioritising projects that it feels will help reduce the national infrastructure gap most effectively. Projects are also selected based on their compatibility with the PPP structure.

Sustainability is another key factor and plays an important role in all of ProInversión’s investment projects. For example, each project is subject to an environmental impact assessment to ensure it does not have a negative impact on the natural or ecological functions of the area. This line of thinking is something we are keen to pursue further, which is why ProInversión is taking greater consideration than ever to commission eco-friendly contracts and green construction projects.

With sustainability in mind, our business strategy has been divided into three basic pillars: identification, segmentation and customer loyalty. By identification, we refer to defining key markets at a global level, as well as reaching out to the top investors of those markets. Segmentation, meanwhile, involves establishing the primary interests of potential investors – essentially, finding out which sectors and specific projects they are keen to invest in.

This is key, as it involves giving potential investors a specific value offering, which also brings us to our third pillar: building customer loyalty. We feel this pillar is best achieved by using several commercial channels – namely hosting domestic events, attending international road shows and utilising digital strategies, among others. Such events are essential because, at present, the most commonly cited challenge to bringing investment projects to market in Peru is the information gap – or, in other words, keeping investors abreast of the latest project developments.

Peru presents a huge opportunity for investors, boasting a combination of advantages that very few countries in the world possess, including macroeconomic stability, a very open legislative framework and a wide range of sectors in which to invest. Despite such benefits, it is calculated that Peru will have an infrastructure gap of roughly $160bn (€137.8bn) until 2025. For this reason, our commercial strategy is of the utmost importance: through it, we can map and monitor the information that investors receive about their projects, as well as any significant movements in the economy and political arena.

Centre of excellence

At ProInversión, we believe that having the best possible investment advisors in place is absolutely vital. The involvement of a highly skilled transaction advisor for each project can be directly linked to the quality of a project’s structuring, profitability and overall success. We strive to bring projects of the highest quality to market. As formulation is key to achieving this, we are in the process of consolidating this phase of each and every project. In addition, we are currently carrying out international public auctions with high technical requirements – this way, we can ensure advisors have the experience needed for the sector in question.

All of our efforts are directed towards becoming a centre of excellence. At ProInversión, we promote private investment, which goes hand-in-hand with a strong commercial strategy. By doing so, we are able to bring key infrastructure players to each sector, as well as strengthen policies to eliminate barriers that investors may otherwise face. While we currently only have a mandate to carry out the structuring and transaction of a project, we are keen to begin supporting grantor entities during the formulation phase of their projects, too.